22+ Mileage Calculator For Work

Web To compute mileage calculations multiply the applicable mileage rate by the number of miles the employee drove. Web MileageWise automatically calculates mileage rates try for free What does the IRS Standard Mileage Rate include.

![]()

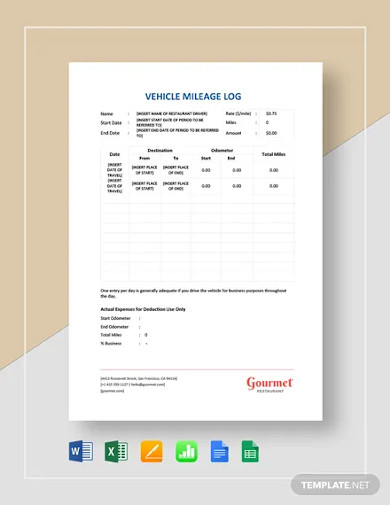

Free Mileage Tracking Log And Mileage Reimbursement Form

Web IR-2022-234 December 29 2022 The Internal Revenue Service today issued the 2023 optional standard mileage rates used to calculate the deductible costs of operating an.

. Distance Between Two Cities Locations Places Points. Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United. Web IRS issues standard mileage rates for 2021.

IR-2020-279 December 22 2020. Web GSA has adjusted all POV mileage reimbursement rates effective January 1 2023. To calculate your mileage reimbursement you can take your total business miles and multiply them.

Web In this example business mileage accounts for 25 of your total mileage. Web IR-2021-251 December 17 2021 The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an. Get Driving Directions with Route Planner 24.

Try Scribd free for 30 days. Web After several months of record breaking gas prices in 2022 the IRS finally relented and increased the standard mileage rate from 585 centsmile to 625 cents for the second. Web business standard mileage rate and the maximum standard automobile cost that may be used in computing the allowance under a fixed and variable rate FAVR plan.

Web The mileage calculator app helps you find the driving distance between cities and figure out your reimbursement using the latest IRS standard mileage rate of 655 as of. WASHINGTON The Internal Revenue Service today issued the 2021 optional. Ad Calculate Distance from A to B.

You should use the corresponding years mileage rate set by the IRS - eg. Web WASHINGTON The Internal Revenue Service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. Web As self-employed you can calculate and claim mileage on your annual tax return.

Web Effective July 1 through Dec. With Scribd you can take your ebooks and audibooks anywhere even offline. You can edit vehicles to personalize the MPG and fuel prices.

Web 17 rows Find optional standard mileage rates to calculate the deductible cost of. Enter your data and then look for the Total Reimbursement amount at the bottom. Web Step 1 of 2.

The same tariffs apply to all passenger cars. Web This calculator can help you track you mileage and can accommodate 2 different rates. Select one or more vehicles.

31 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the 585 cents per mile rate. Ad Access millions of ebooks audiobooks podcasts and more. Distance between two points cities.

For example imagine that your employee drove 15 miles to. You can add edit and remove vehicles at any time.

Mileage Claim Calculator Crunch

Mileage Calculator Credit Karma

Free Mileage Log Templates Smartsheet

Mileage Log 24 Examples Format Pdf Examples

Pinkham Real Estate

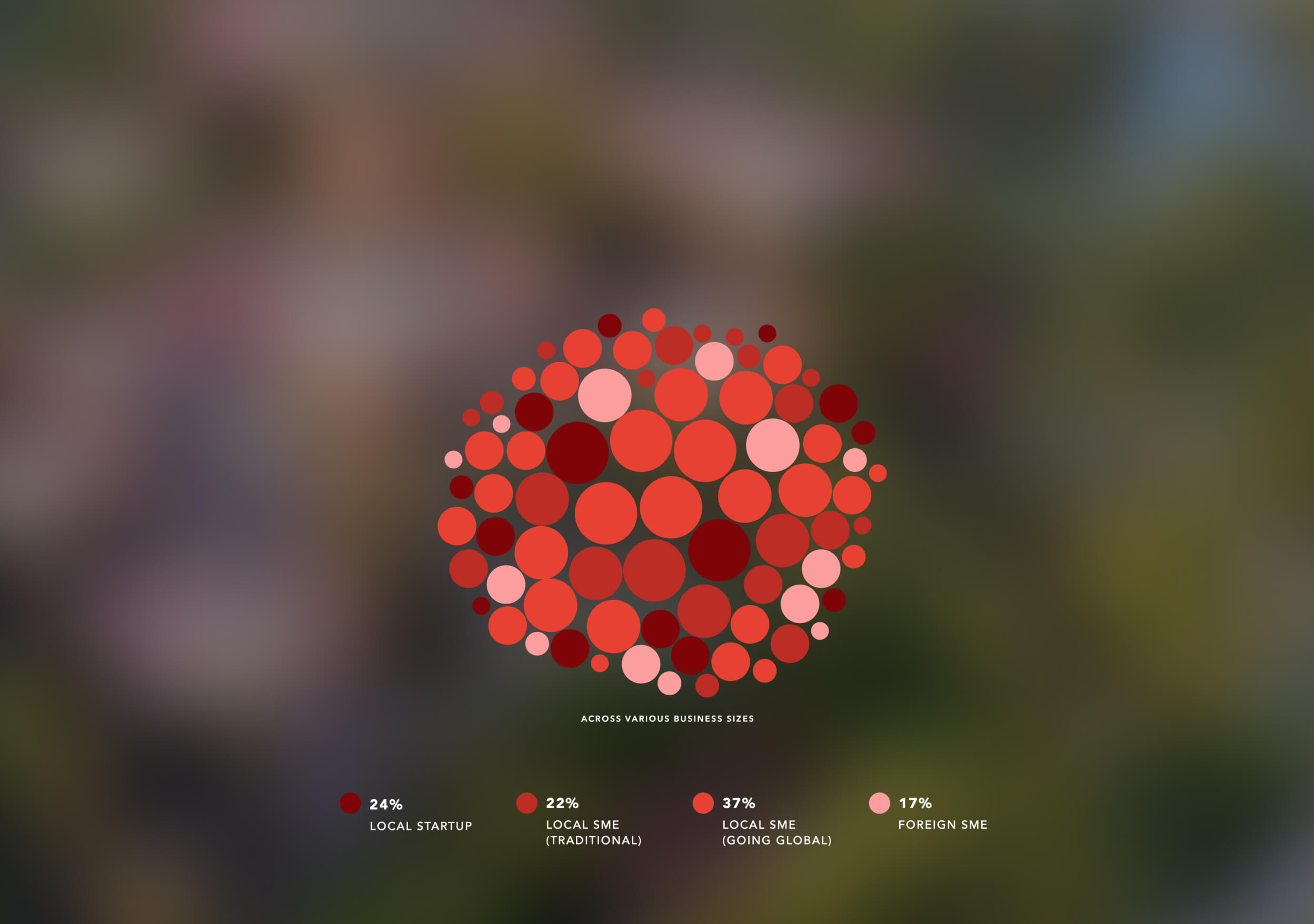

Supporting Organizations Health Care Payment Learning Action Network

Free Mileage Log Templates Smartsheet

Pricing And Plans Enterprise Car Club

Mileage Log 24 Examples Format Pdf Examples

Free Ifta Calculator State By State Mileage Calculator

Module Exercise Mega 1 Pdf Sine Trigonometric Functions

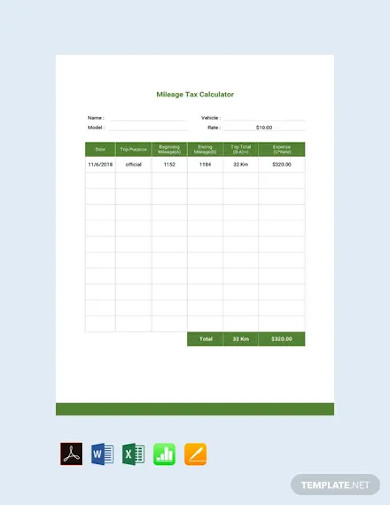

Mileage Tax Calculator Taxscouts

Innjoo Inspire Silver Orange Men S Smartwatch Amazon De Fashion

Aleph Work Standard Chartered

2023 Mileage Reimbursement Calculator Travelperk

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

On Board Vehicle Mpg Calculator Page 2 Bronco6g 2021 Ford Bronco Bronco Raptor Forum News Blog Owners Community